The operating layer for African businesses.

The operating layer for African businesses.

The operating layer for African businesses.

AlvinOS gives African teams access to powerful apps for commerce, travel, events and more,

all on one clean platform built for growth, control and operational clarity.

AlvinOS gives African teams access to powerful apps for Commerce, Travel, Events, and more. All run on a single clean platform designed for growth, control and operational clarity.

Trusted by leading African companies and institutions, from banks to major global summits

Trusted by leading African companies and institutions, from banks to major global summits

Whether you’re selling products online, managing events, or coordinating travel, Alvin brings your operational tools into one place so your team can work faster and stay organized without juggling multiple systems.

Whether you’re selling products online, managing events, or coordinating travel, Alvin brings your operational tools into one place so your team can work faster and stay organized without juggling multiple systems.

Keep operations moving. Even on weekends.

Your team never loses track of a payout or customer order again. Alvin keeps your financial activity organized and up to date — even when your bank is closed.

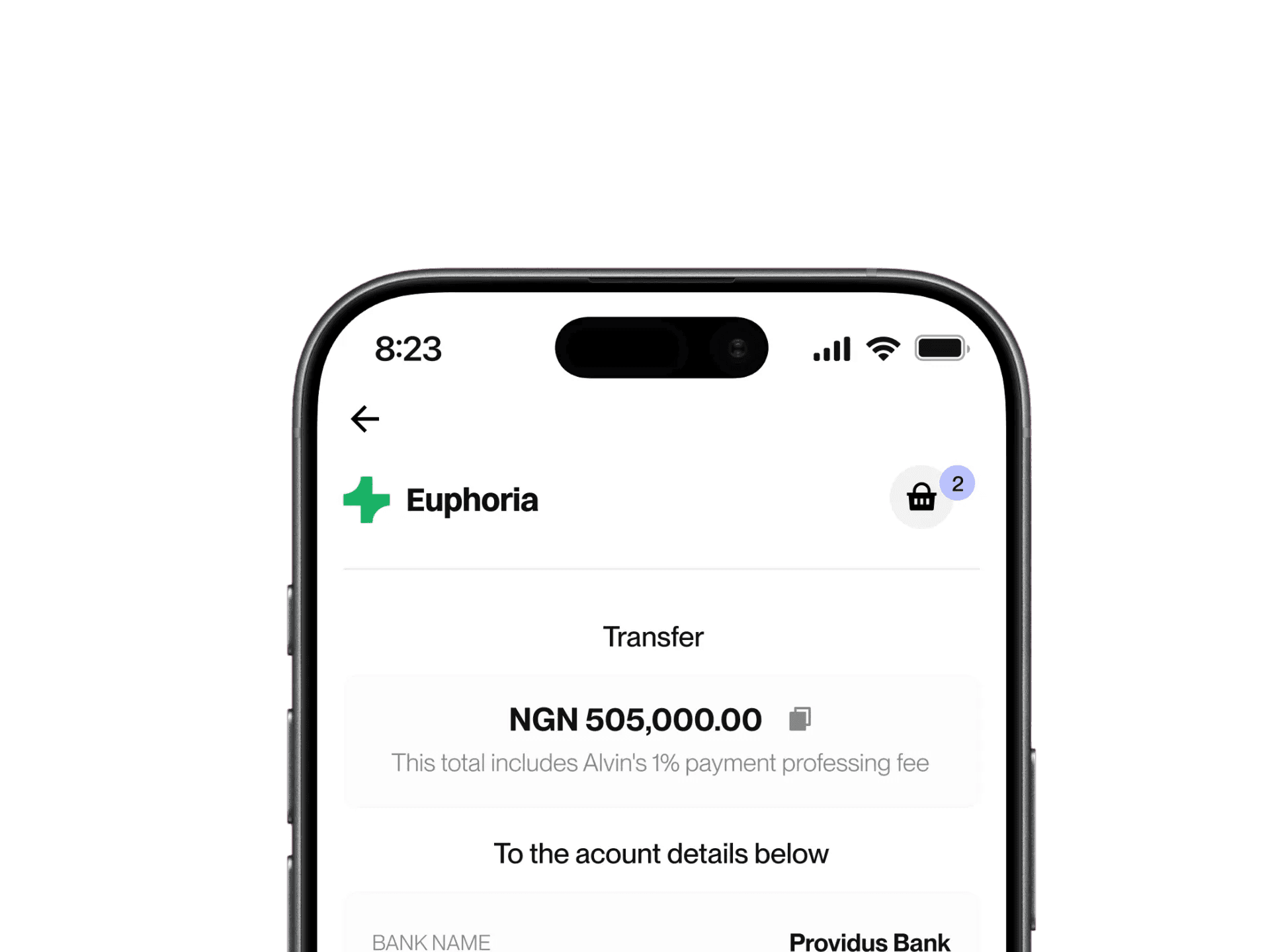

Simple, transparent pricing. No surprises.

One clear rate across transactions so you always know your margins. No hidden fees and no unexpected creeping costs.

Your data. Synced and accurate automatically.

Every payout tracked. Every sale matched. Clean analytics. No spreadsheets. No stress.

We believe African merchants shouldn’t have to wait.

Fragmented systems, unpredictable fees and slow payouts hold back real growth. Alvin brings clarity and full-stack control back to teams — giving them faster access to the money they’ve earned and the tools to stay organized.

Trusted by top investors backing Africa’s next generation of fintech infrastructure

Trusted by top investors backing Africa’s next generation of fintech infrastructure

The operating layer for African businesses built to scale — faster, cleaner and with more control.

Unlock early access to Alvin’s suite of apps for African businesses — built for growth, simplicity and control.

The revenue operating system

for modern African businesses

Nigeria

16 Idowu Martins Street

Victoria Island, 124774

Lagos, Nigeria

Kenya

Global Trade Centre

Westlands Road, 00800

Nairobi, Kenya

South Africa

Atrium on 5th Street, 9th floor

Sandton, 2196

Johannesburg, South Africa

Alvin Technologies, Ltd is a financial technology company incorporated in the U.S. as a Delaware C-Corporation. We are not a bank and do not hold or escrow customer funds. All regulated financial services on Alvin are provided through licensed financial institutions, financial service providers and banking partners in the markets where we operate. Alvin complies with U.S. and local AML, KYC, and data protection regulations through its partners and subsidiaries. We do not offer FDIC insurance or investment services in the United States.

By using Alvin, you agree to our Terms of Use and Privacy Policy, and to comply with all applicable financial and data protection laws in your region.

The operating layer for African businesses built to scale — faster, cleaner and with more control.

Unlock early access to Alvin’s suite of apps for African businesses — built for growth, simplicity and control.

The revenue operating system

for modern African businesses

Nigeria

16 Idowu Martins Street

Victoria Island, 124774

Lagos, Nigeria

Kenya

Global Trade Centre

Westlands Road, 00800

Nairobi, Kenya

South Africa

Atrium on 5th Street, 9th floor

Sandton, 2196

Johannesburg, South Africa

Alvin Technologies, Ltd is a financial technology company incorporated in the U.S. as a Delaware C-Corporation. We are not a bank and do not hold or escrow customer funds. All regulated financial services on Alvin are provided through licensed financial institutions, financial service providers and banking partners in the markets where we operate. Alvin complies with U.S. and local AML, KYC, and data protection regulations through its partners and subsidiaries. We do not offer FDIC insurance or investment services in the United States.

By using Alvin, you agree to our Terms of Use and Privacy Policy, and to comply with all applicable financial and data protection laws in your region.

The operating layer for African businesses built to scale — faster, cleaner and with more control.

Unlock early access to Alvin’s suite of apps for African businesses — built for growth, simplicity and control.

The revenue operating system

for modern African businesses

Nigeria

16 Idowu Martins Street

Victoria Island, 124774

Lagos, Nigeria

Kenya

Global Trade Centre

Westlands Road, 00800

Nairobi, Kenya

South Africa

Atrium on 5th Street, 9th floor

Sandton, 2196

Johannesburg, South Africa

Alvin Technologies, Ltd is a financial technology company incorporated in the U.S. as a Delaware C-Corporation. We are not a bank and do not hold or escrow customer funds. All regulated financial services on Alvin are provided through licensed financial institutions, financial service providers and banking partners in the markets where we operate. Alvin complies with U.S. and local AML, KYC, and data protection regulations through its partners and subsidiaries. We do not offer FDIC insurance or investment services in the United States.

By using Alvin, you agree to our Terms of Use and Privacy Policy, and to comply with all applicable financial and data protection laws in your region.